If you’re reading this, it’s a sign. That you’re finally an adult! Yay! But don’t celebrate just yet! A Singaporean adult’s rite of passage is to go out and get a job, to earn both cash and CPF. As a Singapore job agency, we believe that it is our responsibility to teach budding new employees more about CPF!

Before we dive in and answer some commonly asked questions, here's a short recap on what CPF is:

CPF (A.K.A. Central Provident Fund) is a compulsory savings plan for Singaporeans and Singapore permanent residents. Contributions are made every month to:

-

Ordinary Account (OA): Can be used for housing, investment, education, and CPF insurance.

-

Special Account (SA): For old age and investment in retirement-related financial products.

-

Medisave Account (MA): To be used for hospitalization and approved medical insurance.

Understood? Scroll to learn the answers to some commonly asked questions about CPF in Singapore!

1. Do part-timers in Singapore get CPF?

In case you’re unaware, all Singaporean citizens and Singaporean Permanent Residence will receive CPF, as long as they meet the following criteria:

-

Earn more than S$50 a month

-

Employed in Singapore under a contract of service

This means that even those who work part-time or casual jobs are entitled to CPF payments from their employers. To clarify, CPF classifies employees as:

-

Family workers

-

NSmen pursuing in-camp training

-

Part-time employees

-

Temporary and/or casual employees

-

Company directors

-

Employees

FYI: Don’t feel paiseh to double-check with your employer and ask if you’ll receive CPF during the contract signing. It’s always good to double confirm with a reliable source (i.e. the HR executive, the hiring manager).

2. Who is Not Eligible for CPF Contributions?

Not all working adults in Singapore will be able to receive CPF contributions. This includes:

-

Foreigners (including S pass holders) working in Singapore

-

Singapore citizens and permanent residents working overseas

-

Registered students from certain schools and Madrasah’s working during the school holiday period.

-

Registered students of private institutions, overseas institutions, polytechnics, and Institutes of Technical Education, employed for training approved by their respective institutions during the school/term holidays.

3. How much CPF contribution will I receive?

.png)

Your monthly CPF contribution is made up of contribution from two different parties. Employees below the age of 35 will gain CPF contributions amounting to 37% of their salary every month. Keep in mind that 20% of your salary will be transferred to your CPF accounts. Whilst your employer is responsible for contributing the remaining 17% of your monthly salary to the account.

Did You Know: There is a CPF calculator available online. Click here to visit.

4. Can my employer deduct CPF from my salary even if I’m working part-time?

.png)

It really depends on your monthly earnings. However, as a general rule, employers are not allowed to deduct CPF from your monthly salary when you earn below S$500.

5. What if my employer refuses to contribute to my CPF?

.png)

Fortunately (or not), it is illegal to dodge CPF payments. This law applies to both the employer and the employee. For example, if you’re earning S$2,500 a month. You would have to contribute S$500 of your monthly salary to your CPF fund. On the other hand, your employer will have to contribute an added S$425 per month. Should an employer choose to underpay or not contribute to your CPF, you have the right to lodge a complaint with the Central Provident Fund board.

You can lodge a complaint by:

-

Reporting online

-

Call the WorkRight Hotline (1800-221-992)

-

Via email ([email protected])

-

Visiting any CPF service centres

6. What happens if I refuse to contribute my monthly salary to my CPF fund?

Besides being illegal, it’s virtually impossible for you to do this heist solo. However, risking everything for an extra 20% of your salary might not be worth it. Working employees will gain more through annual interest rates:

-

Ordinary Account (OA): Up to 3.50% per annum

-

Special and MediSave Account (SMA): Up to 5.00% per annum

-

Retirement Account: Up to 5.0% per annum

Think about it - do you really want to skim money off your housing savings? Furthermore, Singaporeans above the age of 55 will receive an extra 1% interest on the first S$30,000 of your combined CPF balance. Which means you’ll be earning up to 6% interest with your CPF savings. Risk-free!

7. Can I still receive CPF payments when I’m on a no-pay leave?

.png)

You will not be able to receive CPF payments or make CPF contributions for the duration of the no-pay leave. Keep in mind that no wages = no CPF.

8. What can I do with my CPF?

There are a number of things you’ll be able to do using your CPF money. Funds from your Ordinary Account (OA) can be used for your housing down payment, mortgage, home protection scheme (HDB only), and even legal fees to name a few. Your Medisave can be used to pay for vaccinations, maternity costs, hospitalization and surgery, as well as palliative care.

9. When will I receive my CPF contributions?

.png)

According to the CPF website, contributions are due at the end of every month. Employers are given a grace period of 14 days to pay it.

And there you have it! Everything a budding employee should know about the CPF! See, it’s not as confusing or difficult as you thought it’d be...right? Remember, your CPF will come in handy as you progress into your old age. In fact, Singaporeans aged 55 years and above will have access to a special fund

A special fund called the Retirement Account (RA) will automatically be made for Singaporeans aged 55 and above. The funds in this account will be accrued from both the individual’s Ordinary Account and Special Account.

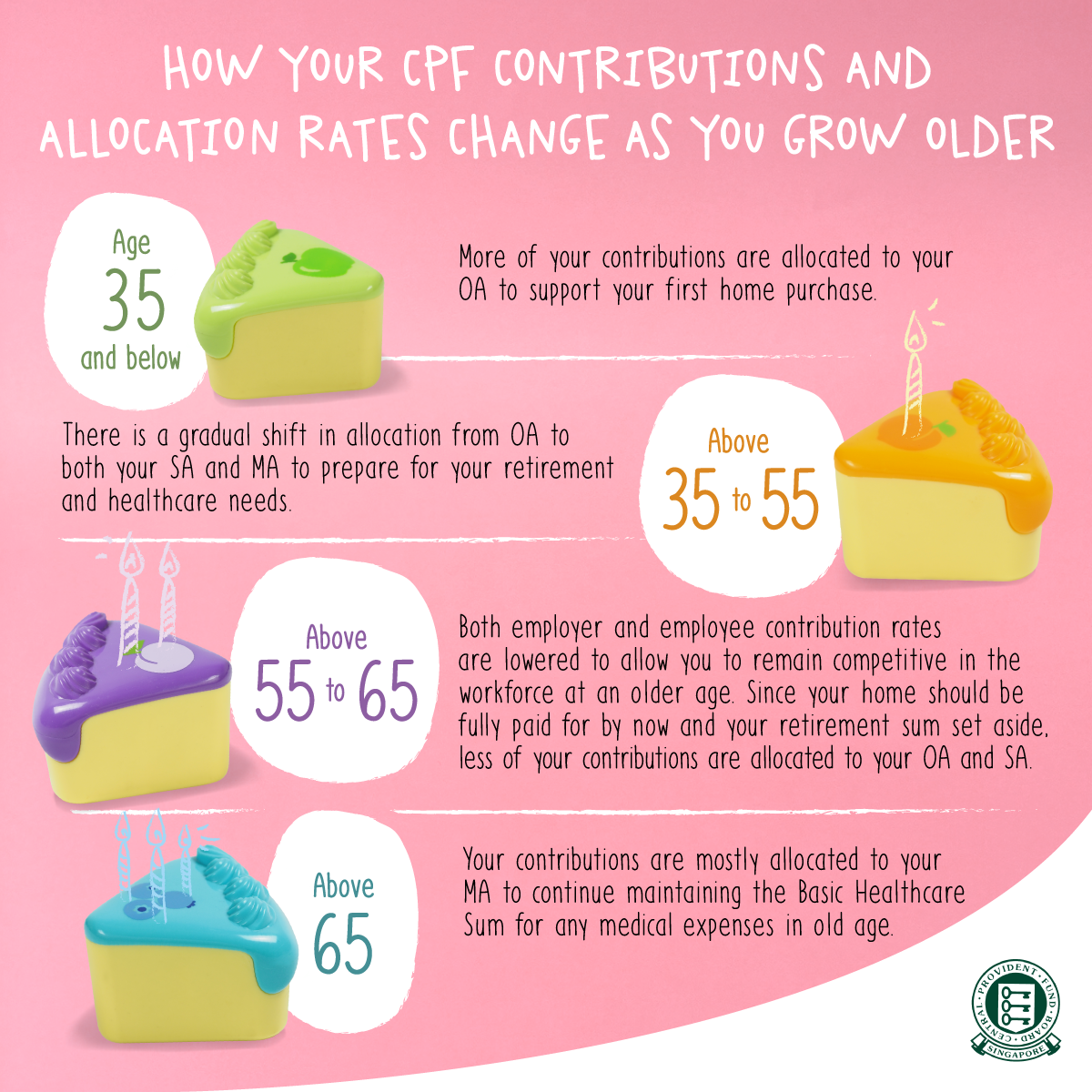

If you’re curious to learn more about the breakdown of your current and future CPF allocation, click here.

Enjoyed this article? Let us know what topics you'd like BGC Singapore to cover in the comments below!